Home Electrical Contractor Free Electrical Contractor Business Plan 8.1 Financial Statement Analysis

8.1 Financial Statement Analysis

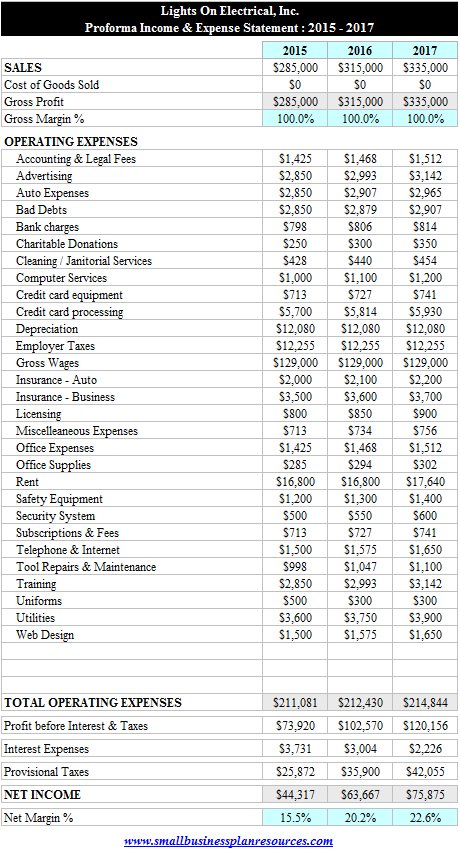

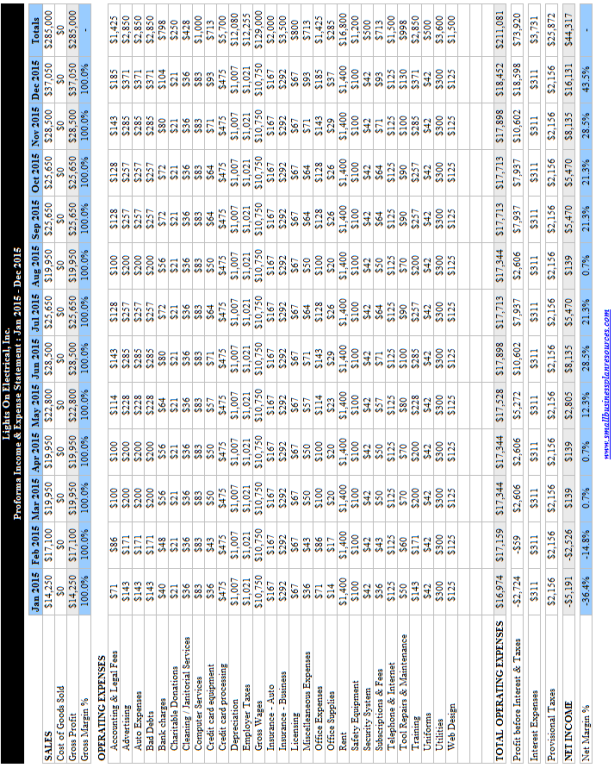

Andy and Jose began by entering in our sales projections that we had arrived at earlier in Section 5.7, 5.8 and 5.9 into the modules. Thus we start with our sales projections of $285,000 year 1, $315,000 for year 2, and $335,000 for year 3 respectively. As you know from our sales forecasting sections there are three possible economic scenarios that we considered when looking at sales forecasting - the slow market, the good or normal market and the great market. We decide to go with the good or normal market condition numbers for the projections in our financial modules since it presented the middle of the road approach towards projections which we felt was appropriate.

Andy and Jose began by entering in our sales projections that we had arrived at earlier in Section 5.7, 5.8 and 5.9 into the modules. Thus we start with our sales projections of $285,000 year 1, $315,000 for year 2, and $335,000 for year 3 respectively. As you know from our sales forecasting sections there are three possible economic scenarios that we considered when looking at sales forecasting - the slow market, the good or normal market and the great market. We decide to go with the good or normal market condition numbers for the projections in our financial modules since it presented the middle of the road approach towards projections which we felt was appropriate.

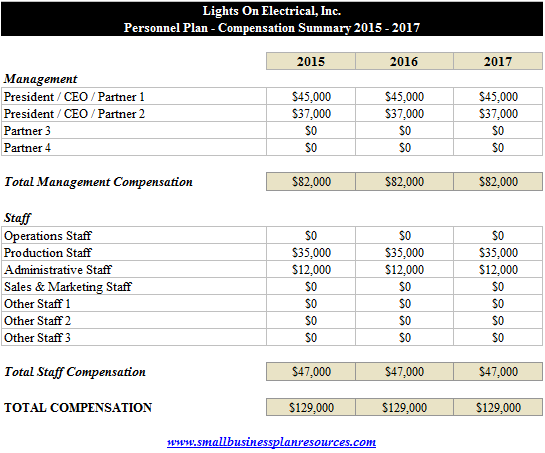

Compensation Forecast:

In our compensation forecast, we are projecting that Andy who owns a larger share of the company will be drawing a salary of $45k in the first, second and third year respectively. Jose who has a smaller share of the company is projected to draw a salary of $37k during the first three years of operations. Both the partners have good personal balance sheets and understand that their business is a pay for performance business - if business is slow, they will have to lower the amount of salaries they give themselves and vice versa. They are both drawing modest salaries with an

eye towards building the cash reserves of the business and making sure that it has the capital needed for future growth.

The largest operating expense for a small business like Home At Last Realty is of course compensation. Given that both the owners have plans of hiring only one admin for the first year and another in the second year of operations, the only compensation expense in the first critical year of operations will be the salaries that they pay themselves and their admits over which they have complete control. Other electrical sub-contractors that may be hired for specific jobs by Lights On Electrical will be compensated for that particular job and paid on a 1099 - they will not be full time employees of the firm. Likewise if the firm decides to take on an apprentice, they anticipate paying the apprentice a modest hourly wage for the specific hours the apprentice is working on projects with either Andy or Jose. They are projecting that

Lameche will be paid $12k a year - they anticipate hiring her on part time basis and as business grows perhaps increase her hours as needed.Capital Contributions:

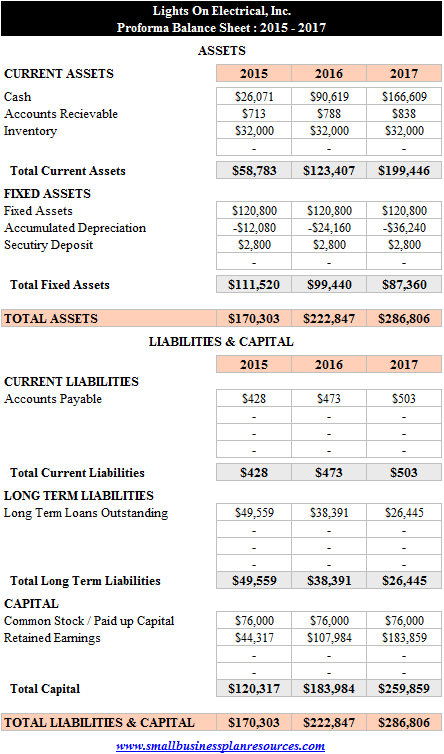

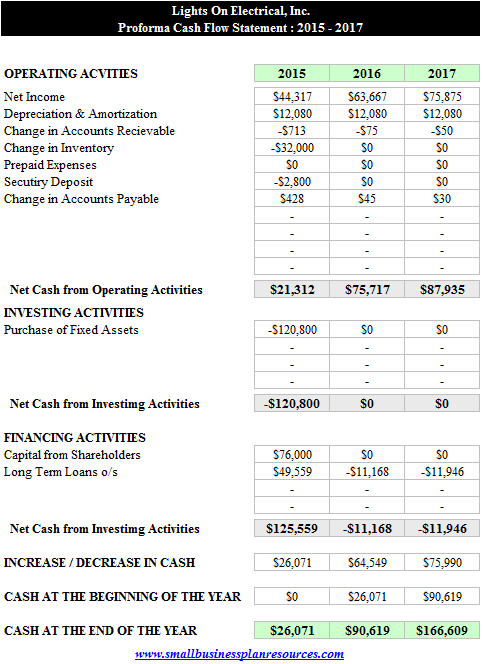

The initial capital contribution from the owners will be a total of $76,000. Jose will be making 64% of the total contribution by bringing $49,000 to the table. Jose will be responsible for the remaining $27,000 representing the remaining 36%. Both the partners don't think that they will need to make any additional contribution to the business, but they are ready, willing and able to do so if the need were to arise.

Loan & Interest Expense Summary:

We will be taking out a fully amortizing term loan from a large local lender where we will be paying back both principal and interest on the loan every month. We have anticipated that a loan in the amount of $60,000 at 6.75% interest for 5 years should do the job for us and we are projecting that we will be putting in for this loan at the outset.

As we keep paying this loan down, we anticipate that the at the end of each year we will have the following projected principal balance outstanding - $49,559, $538,391 and $26,445 for 2015, 2016 and 2017 respectively.

Fixed Asset & Depreciation Summary:

The fixed assets of $120,800 that we have entered in for 2015 includes the upfront capital investments in Customized electrical automotive vans along with tools and equipment, assets like furniture & fixtures, computer hardware & software, printers, security systems, deposit etc that we will need to run the business for the next three years. We don't anticipate adding any more to our existing fixed asset infrastructure unless one of the pieces of equipment goes bad - even in that instant, our product warranties and additional insurance riders should be enough to cover the contingencies.

Purchases, Inventory & Cost of Goods Sold:

In this section we simply enter in the cost of goods sold for each year along with the changes in inventory if any. The projectedcost of goods sold in our case will be $0 since there no intrinsic cost of production for any of our services. This is fairly common for service oriented businesses like Lights On Electrical. Also very common in the service business is no inventory. Typically service businesses don't have any tangible physical inventory besides the purchases of initial tools they need and hence the inventory numbers for all three years of operations are projected to be at $32,000.

Accounts Receivable Summary:

In the electrical contractor business the management of accounts receivables tends to be a major issue especially with large contracts. However since Lights On Electrical is a small sized electrical contractor, they will be instituting and following a policy of payment upon completion of service. In those instances that they do give their clients the ability to pay them after the completion of the job, their payment terms will be Net 7 - bottom line Andy and Jose's customers are going to have to pay up within 7 days of the completion of the services. Further if the jobs are larger than $500, both Andy and Jose will be asking their customers to provide them with a deposit to cover the anticipated cost of purchasing any of the parts needed for the job. Based on all these elements, both Andy and Jose are estimating that their accounts receivables for each of the three years in the business plan will be no more than 0.25% of sales.

Accounts Payable Summary:

In the electrical contracting business, it is fairly typical to be able to get terms of Net 30 when purchasing the parts needed on contracts. However from their extensive past experience both Andy and Jose know only too well, that depending on vendor financing is not a good idea and eventually the cost of financing can also eat away the profit margins on any job very quickly. Thus they will be following a policy of payment upon delivery - paying promptly for the purchases made is one of the hallmarks of excellent cash flow management and fiscal discipline - a common reason why many electrical contracting small businesses fail. With all this in mind, Andy and Jose and projecting a very modest accounts payable of 0.15% of all purchases made for their first three years of operations.

Security Deposit:

A security Deposit in the amount of $2,800 is what we anticipate paying our landlord and that security deposit will of course remain with the landlord for the duration of the three years that are being projected here. This security deposit represents two months rent.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.