Home Financing SBA Loans for Small Business

SBA Loans for Small Business

The U.S. Small Business Administration (SBA) was created in 1953 as an independent agency of the federal government to aid, counsel, assist and protect the interests of small business concerns, to preserve free competitive enterprise and to maintain and strengthen the overall economy of our nation. The SBA recognizes that business is critical to our economic recovery and strength, to building America's future, and to helping the United States compete in today's global marketplace. Although SBA has grown and evolved in the years since it was established in 1953, the bottom line mission remains the same. The SBA helps Americans start, build and grow businesses. Through an extensive network of field offices and partnerships with public and private organizations, SBA delivers its services to people throughout the United States, Puerto Rico, the U. S. Virgin Islands and Guam. (www.sba.gov)

The SBA does not lend money in its own name but instead partners up with local, regional and national lenders and guarantees the loans that they make to small businesses nationally. For this guarantee the SBA charges a fee paid by the borrowers and the bank in turn gets an assurance from the SBA that a part of their loan proceeds has a backstop from the federal government.

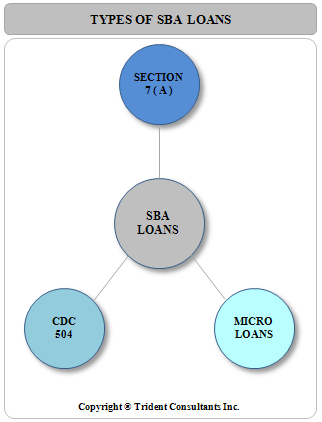

The loan programs offered by the SBA are:

Section 7 (a) programs

Section 7 (a) of the small business act established this program to provide loans to American small businesses. All loans under this program are provided by lenders who are participants with the SBA. There are also a few non-bank lenders who participate in this program. These loans are made directly by lenders and the SBA only guarantees a part of this loan in the event of default. The ability of the borrower to repay the loan is the primary focus of underwriting by lenders under this program and every owner / partner who owns more than 20% of the business has to personally guarantee the loan often offering up their primary residences as collateral to secure successful approval and funding. It is highly recommended by the SBA that your application package include a well thought out business plan that

504 programs

The 504 program was set up to provide long term financing for economic development within a community. The 504 program provides growing businesses with long-term fixed rate financing solutions for the acquisition of fixed assets such as land and buildings. It is a very common program used in the Hotel and motel industry where the business owners / partners are looking to buy the real estate and run it themselves. 504 programs are set up when a lender partners up with a CDC (Certified Development Company). There are 270 odd CDC’s nationally and each covers a specific geographic area.

Typically, a 504 project includes a loan secured with a senior lien from a private-sector lender covering up to 50 percent of the project cost, a loan secured with a junior lien from the CDC (backed by a 100 percent SBA-guaranteed debenture) covering up to 40 percent of the cost, and a contribution of at least 10 percent equity from the small business being helped. The SBA recommends that you have a business plan in place that clearly identifies the project and the benefits that the community will derive from your acquiring the assets. Proceeds from 504 loans must be used for fixed asset projects such as: purchasing land and improvements, including existing buildings, grading, street improvements, utilities, parking lots and landscaping; construction of new facilities, or modernizing, renovating or converting existing facilities; or purchasing long-term machinery and equipment.

The 504 Program cannot be used for working capital or inventory, consolidating or repaying debt, or refinancing. This program only lays out capital to acquire long term fixed assets that in turn have the potential of generating employment and increase business vitality in the local community. Interest rates on 504 loans are pegged to an increment above the current market rate for five-year and ten year U.S. Treasury issues. Maturities of 10 and 20 years are available. Fees total approximately three (3) percent of the debenture and may be financed with the loan. To be eligible, the business must be operated for profit and fall within the size standards set by the SBA. Under the 504 Program, the business qualifies as small if it does not have a tangible net worth in excess of $7.5 million and does not have an average net income in excess of $2.5 million after taxes for the preceding two years. Loans cannot be made to businesses engaged in speculation or investment in rental real estate. (www.sba.gov)

SBA Micro-loans

The Microloan Program provides very small loans to start-up, newly established, or growing small business concerns. Under this program, SBA makes funds available to nonprofit community based lenders (intermediaries) which, in turn, make loans to eligible borrowers in amounts up to a maximum of $35,000. The average loan size is about $13,000. Applications are submitted to the local lenders and all credit decisions are made on the local level. It is highly recommended that applicants have a sound business plan in place before they apply for this loan.

The maximum term allowed for a microloan is six years. However, loan terms vary according to the size of the loan, the planned use of funds, the requirements of the intermediary lender, and the needs of the small business borrower. The maximum loan amount is $35,000. Interest rates vary, depending upon the intermediary lender and costs to the intermediary from the U.S. Treasury. Generally these rates will be between 8 eight percent and thirteen percent. Each intermediary lender has its own lending and credit requirements. However, business owners contemplating application for a microloan should be aware that lenders will generally require some type of collateral, and the personal guarantee of the business owner. (www.sba.gov)

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.