Home Financing Small Business Financing Articles Small Business Loans Checklist - Getting Ready for Financing

Small Business Loans Checklist - Getting Ready for Financing

Small Business Loans Checlist - Getting Ready for Financing

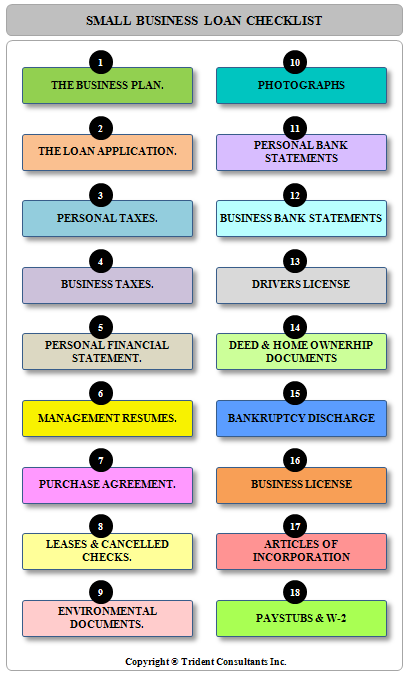

Getting ready for a loan application takes a significant amount of effort and planning. Some of the planning may require the borrowers to start working months ahead of actually applying for a loan. In this section we will take you through the most common mistakes made by business owners / partners when applying for a loan and how you can correctly prepare your loan package to give yourself the best chance of getting approved. Presented below are most of the items you need to get ready for a business loan:

1. Business Plan:

The single most important item that you can have in your business loan application package is a professionally created business plan that adheres to the preferred SBA format and is accepted by bank and non-bank lenders all over. The most common mistakes that business owners / partners make is to underestimate the significance of the business plan and rely on a few pages of loosely put together documentation that is a caricature of a real business plan. The best investment you can make is to have your business plan written by plan writing professionals at Trident Consultants Inc.

2. Loan application:

The second most important element of the loan package is a thoroughly and thoughtfully completed loan application package. To get a detailed breakdown of the questions that you will face in a business loan application and how to go about answering each of them please look at our section entitled The Business Loan Application. Every item in the loan application if not answered correctly and completely can potentially affect the lending decision. In general lenders like to see a well-filled out application – by that we mean that the fewer blank lines the better. Take time to fill out the seemingly innocuous details like middle name, prefix, suffix etc. Where ever you have the opportunity, make sure you enumerate what it is you do and why you need the money.

3. Personal Taxes for 3 prior years:

Most lenders will require that you provide them with three years worth of personal tax returns. While some may only require you to provide two years worth, any SBA loan will certainly require three. Please make sure that the returns that you provide the lender are duly signed by you and your spouse (if applicable) and also has the name of the preparer and a telephone number for them. Make sure that you include all pages of the federal tax returns. Remember that many lenders require you to sign an IRS form 4506-T that gives them the right to request a copy of your filed returns from the government to verify the information that you are providing them on the business loan application is indeed accurate and true.

4. Business Taxes for 3 prior years:

In the event you are an existing business looking for a new or additional lines of credit or a business loan, you will need to provide three years worth of tax returns on the business entity that operates the business in whose name you will be applying for a loan. In the case of new businesses of course this option is not possible but you will need a sound business plan that shows pro-forma financial statements for the next three years. If you are an existing business and are submitting business taxes please make sure that they are duly signed by you or the authorizing officer for the company and have the name and number of the tax preparer and also make sure that you have included all pages of the tax return for the lender to review.

5. Personal Financial Statement:

Besides the tax returns and business loan application forms, many lenders also have a separate personal financial statement (PFS) from that you have to complete. All the questions that you will face in the personal financial statement are covered under our section entitled The Business Loan Application. Make sure that your personal financial statement is dated and signed by you and the information provided in the form corresponds with the information on your tax returns. You may need to consult with your certified public accountant (CPA) before you fill out one of these.

6. Management Resumes:

While most lenders require personal financial statements from all shareholders who own 20% or more of the business entity, we highly recommend that you include management resumes of all the key players in your business enterprise along with a cover letter that explains the various roles and duties of each individual. It is important to note that this information should match up with the management section of the business plan that you will be submitting in the package. The SBA has separate forms for resumes of all applicants and require a detailed breakdown of work experience, education and other information that can help them in determining the character and expertise of the guarantors.

7. Purchase agreement:

In the event you are buying a business you will need to provide the purchase agreement that governs the transaction. Although it may sound obvious, do take some time to make sure that the purchase price is the same as stated in the application and the purchase agreement has been executed by both you the buyer and the seller or their representative.

8. Leases & cancelled checks:

In the event you are buying a business that includes a lease to a property that you will be occupying, the lender will need to take a look at the lease to make sure that the rental payments in the lease are properly accounted for in the calculation of debt service. In addition banks may also request copies of rent checks (both front and back) to be provided in the business loan application. We recommend having at least six months worth of these cancelled checks ready to go in the event the bank makes this request.

9. Environmental Documents:

The purchase or startup of businesses that have environmental issues always requires an environmental questionnaire – please make sure you check with your business banker and include this form in your package.

10. Photographs of new location, business:

If possible and if applicable make sure that you provide the banker taking your application with photographs of the new business that you are purchasing or the property where the business is located. Business owners buying hotels, motels, gas stations, Laundromats, deli’s, restaurants, fast food franchises and any other business that has a physical presence should always try and include photographs of the location that they are looking to buy or where they are looking to startup their new venture.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.