Home Financing Personal Credit and Business Credit Credit Report and Credit Score Analysis

Credit Report and Credit Score Analysis

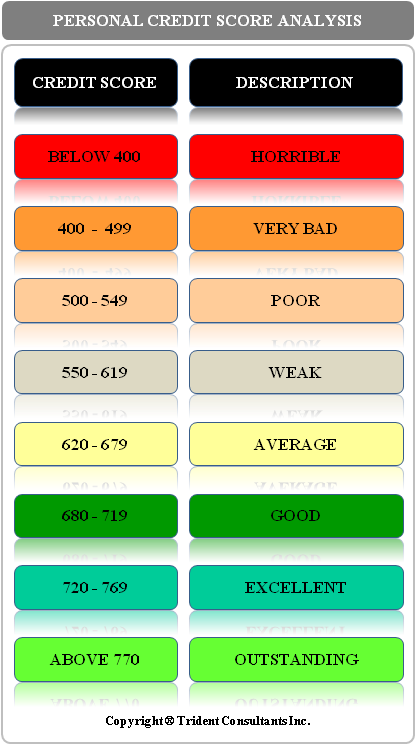

2. What is a good credit score?

While each lender has their own internal requirements for minimum and optimum credit scores, the generally accepted norm is the higher your credit score the better your chances of getting a business loan. Credit scores range from 400 to 850 with the average credit score in the United States currently at around 675.

When looking at business loans lenders usually require a credit score of at least 650 to 660. If your credit score is more than 680 you have good chance of being approved; If your scores is above 700 your chances of approval improve dramatically. We must keep in mind that credit scores are one element of the loan package and just because the business owner / partner has a relatively low credit score does not automatically preclude them from getting a loan. Many times even if the credit score is below 650, if there is a lot of collateral that the bank may consider that as an offsetting factor to the low credit scores and still approve the loan. To view a sample personal credit report and understand the information presented go out our section entitled Analysis of a sample credit report.

3. Different kinds of personal credit reports

Credit reportsmay be prepared by an independent consumer credit reporting agency or one of the national credit repositories. Acceptable formats for these traditional credit reports include an “in-file” credit report, an automated “merged” credit report, and a residential mortgage credit report.Traditional Credit Report

A traditional credit report must include both credit and public record information for each locality in which the borrower has resided during the most recent two-year period. If the lender relies on a credit report from a foreign country to document a borrower's credit history, the credit report either must be completed in English or include an English translation, and must satisfy the same basic standards for authenticity, accuracy, and completeness that are applied to other credit reports.

The credit report must include all discovered credit and legal information that is not considered obsolete under the Fair Credit Reporting Act. Although the Fair Credit Reporting Act currently specifies that credit information is not considered obsolete until seven years and bankruptcy information is not considered obsolete for ten years.

Each credit report must include all available public records information; identify the sources of the public records information, and disclose whether any judgments, foreclosures, tax liens, or bankruptcies were discovered (with these adverse items reported in accordance with the Fair Credit Reporting Act). Public records information must be obtained from two sources, which may include any combination of the following - national repositories of accumulated credit records, direct searches of court records by employees of the lender or the consumer reporting agency, or record searches made by other public records search firms.

The credit report must include the full name, address, and telephone number of the reporting agency, as well as the names of the national repositories that the agency used to provide information for the report. The collected information should not be changed — although it is permissible to delete duplicate information, to translate codes to “plain” language, and to make appropriate adjustments to resolve conflicting information to ensure the clarity of the report.

The credit report must indicate the dates that accounts were last updated with the creditors. Each account with a balance must have been checked with the creditor within 90 days of the date of the credit report. All inquiries that were made in the previous 90 days must be shown on the report. The reporting agency must make responsive statements about all items on the credit report — indicating “unable to verify” or “employer refused to verify,” when appropriate. The reporting agency must present all data in a format that is easy-to-read and that is understandable without the need for code translations.

For each debt listed, the credit report must provide the creditor's name, the date the account was opened, the amount of the highest credit, the current status of the account, the required payment amount, the unpaid balance, and a payment history. In all cases, the report should list the historical status of each account. This status must be presented in a “number of times past due” format and include the dates of the delinquencies

In-file Credit Report

“In file” credit reports are simply the reports that each repository has on the borrower. Each of the repositories can be contacted by the lender for the each of the files they have “In house” on the borrower. Sometimes, lenders may be able to use “In File” credit reports from 2 repositories alone if that is the only extent to which data is reported. Also if other 2 repositories of data report a very high score then the lender may waive the requirement for the third repository.

Automated ‘Merged’ Credit Report

A merged credit report is simply an electronic combination of the information from the “In File” reports that each repository has in its database. There are many credit reporting agencies that provide “Merged” credit reports and these reports are most often used by the lending industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.