Home Financing Personal Credit and Business Credit All About Business Credit

All About Business Credit

- An Introduction to Business Credit

- The Creation of Business Credit

- D&B Paydex Scores and what they mean

- D&B Commercial Credit Scores and what they mean

- How to go about setting up your Business Credit?

1. An Introduction to Business Credit

Being able to obtain financing at the right time and at favorable terms is one of the key challenges facing every business owner / partner. Getting money at the right time can often make the difference between success and failure; between being able to expand operations or staying small – thus we must make every effort to prepare ourselves before we approach banks for capital.

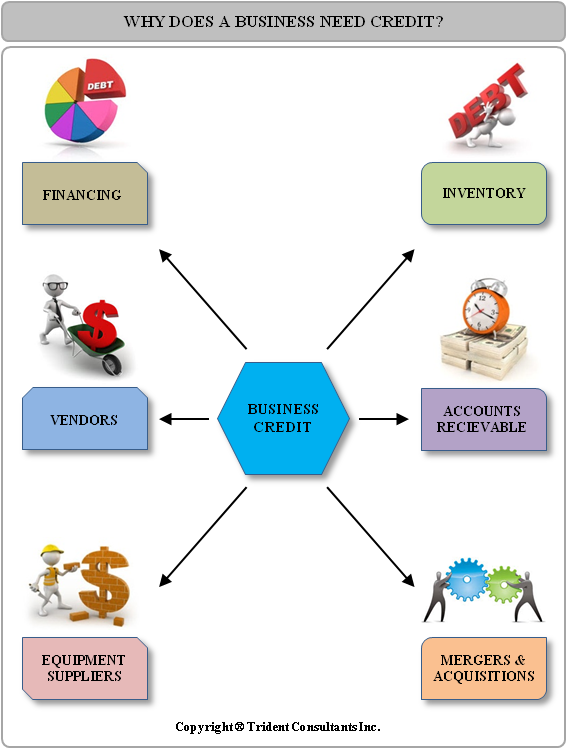

In the world of small to mid sized businesses having a good business credit score and profile is often overlooked and its implications not well understood. Let us take a few minutes to understand how much impact business credit can have on a business:

1. Financing: This one is easy – if you don’t have a good business credit score or don’t have any business credit history at all, it becomes very hard for you to raise capital in the name of your business. The business owners / partners now have to depend on their own personal resources to contribute capital into the business. Often times this is not easy since they may not have good personal credit scores and even if they do the capital that they borrow in their own personal name will show up on their personal credit bureaus and will affect their ability to raise more capital in the future or get personal loans for their homes, cars etc. In comparison, having a good business credit score and profile gives the business owners / partners the ability to raise this capital in the name of the business and most times these lines of credit or corporate credit cards and loans do not show up on their personal credit bureaus.

2. Vendors: What many business owners / partners do not realize is that before a vendor offers you their goods or services, they often run a credit check on your business. If you have a good business credit score and profile, they are more likely to want to do business with you and chances are they may even offer you credit terms at a more favorable level then if you did not have a good business credit score. Over time this can mean a substantial improvement to your cash flow and at other times it may be the difference between being able to get a good supplier to sell you their goods at all! If you do not have a good and profile, you may be relegated to having to deal with the worst suppliers in your industry who will demand cash or even worse will extend you credit at the worse terms possible. To businesses that depend on vendors for their merchandize, this can often create a serious disadvantage especially in the intensely competitive business environment that we all live in.

3. Equipment Suppliers: Just like vendors, equipment suppliers also check on the business credit score and profile of their customers (in this case, you) before they do business with them. It is no secret that the rates of leases and the terms offered in equipment leases depend completely on the business credit score and profile. For example if you are a moving company and you lease your trucks which results in a very serious capital expense every month, a good rate of interest and decent terms on your lease may give you just that extra edge you need which you can pass along to your customers in the form of better prices thereby undercutting your competition.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.