Home Restaurant Free Restaurant Business Plan 8.16 Debt to Asset Ratio Analysis

8.16 Debt to Asset Ratio Analysis

The Debt to Assets ratio is a key ratio that is looked at by lenders and potential partners alike and hence it is very important to a small business owner like Jack Gordon. Just like the Debt to Equity ratio, it measures how much leverage a small business has employed to deploy the assets it currently has. Unlike the Debt to Equity ratio which measures the amount of debt to the shareholders equity, the Debt to Assets ratio looks at the leverage that is employed on the Assets of the small business.

The Debt to Assets ratio is a key ratio that is looked at by lenders and potential partners alike and hence it is very important to a small business owner like Jack Gordon. Just like the Debt to Equity ratio, it measures how much leverage a small business has employed to deploy the assets it currently has. Unlike the Debt to Equity ratio which measures the amount of debt to the shareholders equity, the Debt to Assets ratio looks at the leverage that is employed on the Assets of the small business.

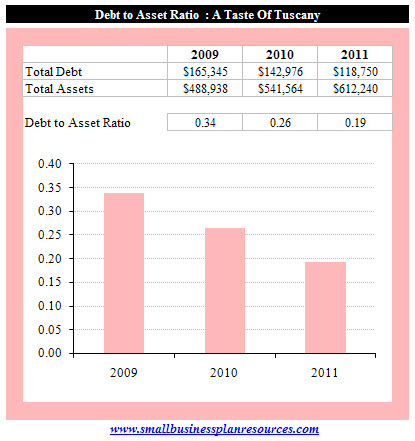

As we can see from our analysis, the debt to asset ratio for A Taste of Tuscany is projected to be 0.34, 0.26 and 0.19 for 2009, 2010 and 2011respectively. The total debt is expected to be $165k, 142k and 118k for the years ahead and the total assets are projected to be $488k, 541kand $612k respectively.

We anticipate that with the largest debt load when we get going, the debt to asset ratio will be the highest upfront and then will start improvingas we begin paying the debt down and also as the amount of our cash reserves which are part of the total assets, start getting healthier duringour second and third years of operations.

In the event we have to take on more debt, or if we are not able to generate the kind of cash we are projecting, this key ratio will be negativelyimpacted.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.