Home Roofing Contractor Free Roofing Contractor Business Plan 8.11 Return on Equity Analysis

8.11 Return on Equity Analysis

The Return on Equity Ratio measures the ability of a small business like Dependable Roofing Inc. to be able to generate bottom line Income (Net Income) for its shareholders and is a key ratio that is looked at by lenders and especially potential partners when they are looking to either lend money to the business in the form of a business loan or make an investment into the business.

The Return on Equity Ratio measures the ability of a small business like Dependable Roofing Inc. to be able to generate bottom line Income (Net Income) for its shareholders and is a key ratio that is looked at by lenders and especially potential partners when they are looking to either lend money to the business in the form of a business loan or make an investment into the business.

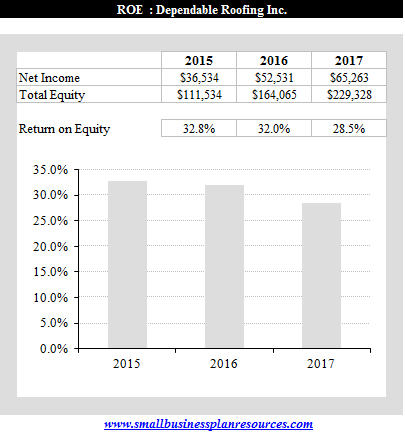

We are projecting that for the return on equity for Dependable Roofing will be 32.8%, 32% and 28.5% for 2015, 2016 and 2017 respectively. What this implies is that for every $1 invested in Dependable Homes by James and Carmine, the firm will generate 67 cents in 2015, 68 cents in 2016 and 72 cents in 2017. That is an excellent return on the initial amount invested and all retained earnings invested back in to the business for the owners.

Net Income is of course the final net income from which the shareholders or owners will get paid a distribution and it is projected that the net income for the next three years will be $36,534, $52,531 and $65,263. Total equity that includes the original contribution from shareholders adjusted for retained earnings and distributions is projected to be $111,534 $164,065 and $229,328 respectively. It is important to note that the net income included here already has accounted for the salaries paid to James and Carmine

The reason for the decline in the return on equity for the second and third year is the fact that all the retained earnings will be added back to the business by the owners. This of course increases the total equity that both the owners have in the firm. The rationale behind investing the cash surplus is to be able to build up a solid cash reserve that is needed when one goes after larger contracts. Surety bonds require a very high level of equity in the business to be able to provide the higher levels of bonding that is required with larger projects. Once sales start growing, we anticipate that the Net Income for Dependable Roofing will also grow proportionately resulting in improving return on equity ratios.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.