Home Roofing Contractor Free Roofing Contractor Business Plan 8.13 Debt to Equity Analysis

8.13 Debt to Equity Analysis

The Debt to Equity ratio is a key ratio that is most widely used in the analysis of financial statements for a small business like Dependable Roofing Inc. It measures the amount of protection the creditors of the small business have when compared to the amount of equity invested by the owners of the small business. It also shows how much each party has vested in the small business. This is a very significant ratio looked at by potential investors like venture capital firms who want to see not only if there is a return on their capital but if there will ever will be a return of their capital!

The Debt to Equity ratio is a key ratio that is most widely used in the analysis of financial statements for a small business like Dependable Roofing Inc. It measures the amount of protection the creditors of the small business have when compared to the amount of equity invested by the owners of the small business. It also shows how much each party has vested in the small business. This is a very significant ratio looked at by potential investors like venture capital firms who want to see not only if there is a return on their capital but if there will ever will be a return of their capital!

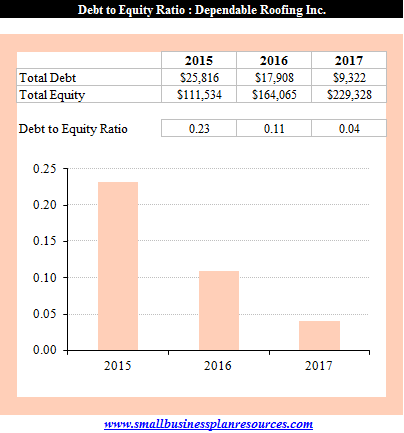

We are projecting that the debt to equity ratio for the first three years of our operation will be 0.23, 0.11 and 0.04 for 2015, 2016 and 2017 respectively. This is an excellent progression for James and Carmine since it shows a steadily improving equity interest for as their business grows. The debt that is referenced here is of course the original loan of $33,100 that will be taken out at the outset. At end of each year the amount of the loan that will be left over is projected to be $25,816 $17,908 and $9,322 - this of course is because the loan amount will kept getting paid down by Dependable Homes.

As the debt on the books of the business keeps decreasing, the amount of equity in the business keeps on growing as well - this is because the owners will be investing the profits from the business back into the shop and thereby increasing their equity. This will also contribute to dramatically reducing the debt to equity ratio to 0.04 by their third year of operation.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.