Home Financing Small Business Financing Articles Small Business Loans - Five C's of Lending

Small Business Loans - Five C's of Lending

Small Business Loans - The Five C's of Lending

Applying for a business loan is a very important part of securing the capital required to open, start or expand a business and yet many business owners and partners know very little about this part of raising capital. Having the correct information in the right order and providing that to the business banker is critical to getting a successful decision on a business loan application. Also of great importance is a well thought out business plan that lays out your map for growth and profitability.

Business owners must recognize that banks are looking not only for a return on their capital but also a return of their capital. It is no surprise that in an economic downturn industries like the food and accommodations represented by restaurants and motels have the toughest time getting business loans. Yet, no matter how tough the economic environment or underwriting standards of the lender, the business owner / partner have to put their best food forward and package their loan documents professionally and present that to the bank along with a solid business plan – this will certainly increase their chances of successfully securing financing.

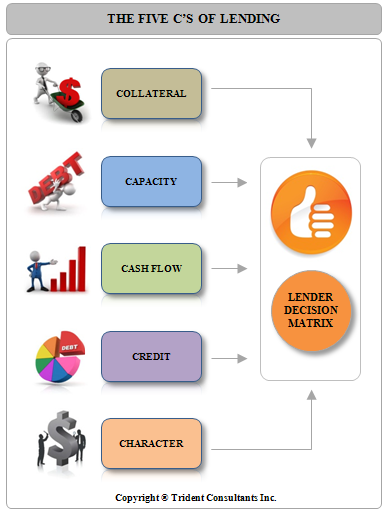

The five C’s of the lending world are Credit, Collateral, Capacity, Cash flow and Character. It is very important to understand that these are the elements that a bank looks at when it evaluates a potential business loan. As long as the client is able to meet these criteria they have a very good chance of securing their business loan or at least getting a counter offer from the bank for a smaller amount instead of the loan they applied for. Let’s discuss these for bit:

Credit:

This of course deals with the credit of the borrower and the credit of the business applying for a loan. When evaluating the personal credit of the guarantors the lender will look at the credit scores as reported by the three credit repositories – Equifax, Transunion & Experian; also evaluated is the revolving debt ratio, and the length of time credit history is being reported. On the corporate credit side the lender will evaluate the D&B (Dun and Bradstreet) business credit report on the company if available.

Collateral:

Here the lenders look at what assets they can secure a lien against in the event the guarantor of the loan fails to make payments. Typically the assets that they look for are the business assets, office equipment, furniture, commercial real estate or residential real estate. Many times prior to funding a business loan, the lender will require that a UCC-1 (Uniform Commercial Code -1) be filed against the general assets of the business. This gives the lender the right to request a court to dispose of the assets and pay them back the balance owed to them in the event the business is not able to repay the loan.

Capacity:

In evaluating the capacity of the business to pay back the loan, the lender is simply looks at the guarantors ability to pay back debt past, present and future, the timings of repayment and the probability of a successful repayment of their loan. Excessive credit inquiries, high debt ratios and joint versus individual credit will be looked at along with business knowledge, experience in the industry and a sound business plan.

Cash Flow:

“Cash is King” is often heard in lending and financing circles and it points to the fact that as long as a business is generating enough cash to pay it’s obligations and survive, it will sooner or later be successful in its respective industry all other things remaining the same. Typically lenders look for a debt service coverage to be 1.25x (times) of the debt service – thus if the annual debt service for the business is $75,000 the business has to have at least $93,750 of free cash flow for the bank to look at the deal in a positive light. Each lender has their own debt service coverage requirements so check with your banker. When evaluating cash flow a lender will consider the off balance sheet debts, personal debts for the business owners and partners, accounts receivables and accounts payables, the payment terms for the vendors, the sources of inventory and supplies and what credit they extend to the business and of course the use of the loan monies being applied for.

Character:

The fifth element of the lending world is a lot less understood by business owners / partners. It is the most subjective element and it is where a well thought out business plan can perhaps help out the most. Lenders want to know that the business that they are lending to is trustworthy and that they are committed to growing, expanding and being profitable. They look for consistency in the information being provided, their ability to verify the information being provided and how quickly their requests for further documentation are being met by the borrowers. Business and personal references play a big part in evaluating business character and the business owners and partners would be well advised to have a good board of directors or advisers who can add authenticity to their enterprise and ethics.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.