Home Roofing Contractor Free Roofing Contractor Business Plan 2.6 Loan Summary Analysis

2.6 Loan Summary Analysis

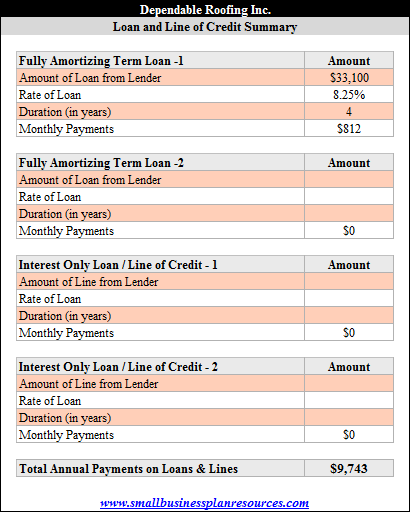

James Kelly and Carmine Russo of Dependable Roofing are looking to secure a term loan in the amount of $33,100 from a local community lender in Kent county, Michigan. Both the owners have an excellent track record of working as independent roofing contractors in the target market and have been able to create excellent personal balance sheets and credit histories. Besides having the expertise in the industry, they will also be able to provide the lender with business and character referrals.

James Kelly and Carmine Russo of Dependable Roofing are looking to secure a term loan in the amount of $33,100 from a local community lender in Kent county, Michigan. Both the owners have an excellent track record of working as independent roofing contractors in the target market and have been able to create excellent personal balance sheets and credit histories. Besides having the expertise in the industry, they will also be able to provide the lender with business and character referrals.

It is anticipated that the bank will approve the term loan for a 4 year period for an interest rate of 8.25% - the reason we are estimating a slightly higher rate of interest is because of the relatively riskier nature of work involved with roof contracting work. It is also anticipated that the bank may stipulate that the approval be subject to the firm carrying a certain amount of business liability insurance over and above the state mandated workmans compensation insurance for all employees and sub-contractors.

The owners are also aware that in the small business world, almost all business loans secured in the name of a company have to be backed by the personal guarantee of the business owners. These kinds of loans are called 'Full Recourse' loans and what that means if that the borrowers are personally and jointly liable for the outstanding principal and interest on the loan - if they were to default on their payments, the bank could go after their individual personal assets.

In the event the lender only approves part of the loan or denies the loan, James and Carmine are ready, willing and able to contribute the $33,100 needed directly from their personal savings.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.