Home Roofing Contractor Free Roofing Contractor Business Plan 4.24 Market Value of Owned Home by Occupation Nationally Analysis

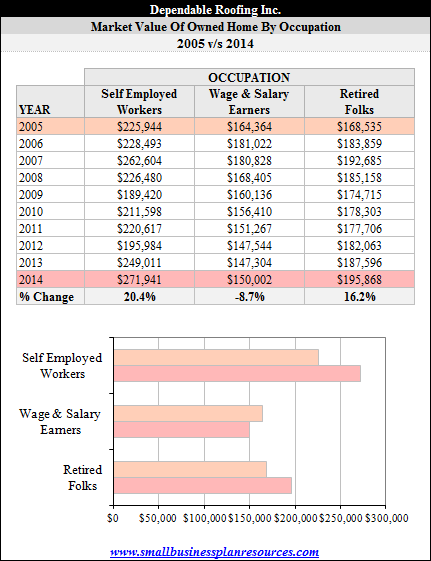

4.24 Market Value of Owned Home by Occupation Nationally Analysis

In order to analyze the market value of owned homes by occupation we have broken the national population into the following categories:

In order to analyze the market value of owned homes by occupation we have broken the national population into the following categories:

- The average market value of owned home by folks who are classified as self employed workers.

- The average market value of owned home by folks who are classified as wage and salary earners.

- The average market value of owned home by folks who are classified as retired.

It is not surprising to see the findings of our analysis that shows that over the last ten years of the analysis, self employed workers have had the highest market values for their homes as compared to the other two categories. Back in the year 2005, the national average market value of an owned home for someone who was self-employed was $225,944 and in 2014 that number rose to $271,941. What is interesting to note however is that of all the three categories of occupation, this approximately 20% rise in the market value of owned homes was actually the largest increase.

The market value of homes owned by retired folks have actually show a similar percentage increase having gone up 16.2% in value from $168,525 to $195,868 over the same time period. Wages and salary earners have not enjoyed a similarly increase in the market value of their homes with the average home prices actually decreasing 8.7% during the same period. The average wage earners home was valued at $164,364 back in 2005 and a decade later it was valued at $150,002. This may have a lot to do with the decline in real wages and that of course impacts the affordability of where one can buy a home.

The market value of homes belonging to folks who are retired are roughly 25% compared to the market value of homes belonging to folks who are self employed over the course of the decade during which this analysis was conducted. Interestingly the difference in market values of homes belonging to retired folks was only roughly 6% higher between 2005 and 2010, but between 2011 and 2014 this difference has ratcheted up to 19% - basically the home values of wage earners have actually not been able to keep up with the pace of the home values of retired folks.

Clearly from a marketing perspective this presents an interesting challenge to Dependable Roofing. While the conventional thinking may well be that it is wiser to market more aggressively to folks who are earning a wage rather than those who have already retired, when it comes to home values we find that folks who are retired have on average higher valued homes even though they are not actively earning any more wages. James and Carmine of Dependable Roofing will have to be tactically smart and offer a different menu of roofing material and prices to folks who are busy wage earners compared to folks who are retired. Retired folks may not have much disposable income but they have a lot of equity in their homes since they probably have paid their mortgages off

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.