Home House Cleaning Service Free House Cleaning Service Business Plan 8.12 Times Interest Earned Analysis

8.12 Times Interest Earned Analysis

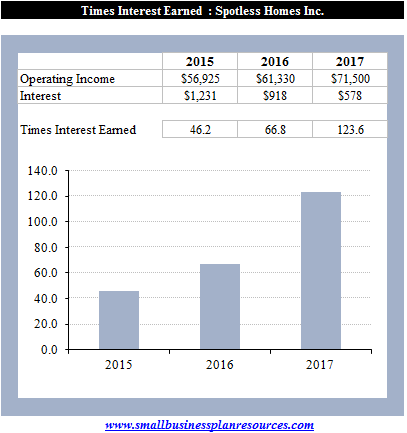

The Times Interest Earned Ratio is an excellent profitability ratio and also one of the most common ratio that is used by lenders when making business loans. The Times Interest Earned Ratio is arrived at by dividing the operating income by the interest expenses faced the small business on all its debt obligations. Thus the times interest earned ratio measures the ability of the small business to cover its interest cost from its operations.

The Times Interest Earned Ratio is an excellent profitability ratio and also one of the most common ratio that is used by lenders when making business loans. The Times Interest Earned Ratio is arrived at by dividing the operating income by the interest expenses faced the small business on all its debt obligations. Thus the times interest earned ratio measures the ability of the small business to cover its interest cost from its operations.

We are projecting that the times interest earned ratio for Spotless Homes will be 46.2, 66.8 and 123.6 for 2015, 2016 and 2017 respectively. These are some excellent numbers. A small business uses its operating income which is the profit before income and taxes to make interest and tax payments. Clearly the higher the operating income the better the ability of the business owners like Anthony, Christine and Sofia to pay the interest on their loans. Both the owners do not believe in debt and have only opted to apply for one four year term loan. As time progresses the interest component of the loan will begin dwindling down and that is why we have an improving times interest earned ratio for the firm.

Clearly if, the business was to take on more debt resulting in higher interest payments, the times interest earned ratio would be impacted negatively. Alsoif the operating income were to be reduced due to slower sales combined with higher operating expenses, this ratio would again get worse.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.