Home Mortgage Broker Free Mortgage Broker Business Plan 4.6 Target Market Owner Occupied Units Analysis

4.6 Target Market Owner Occupied Units Analysis

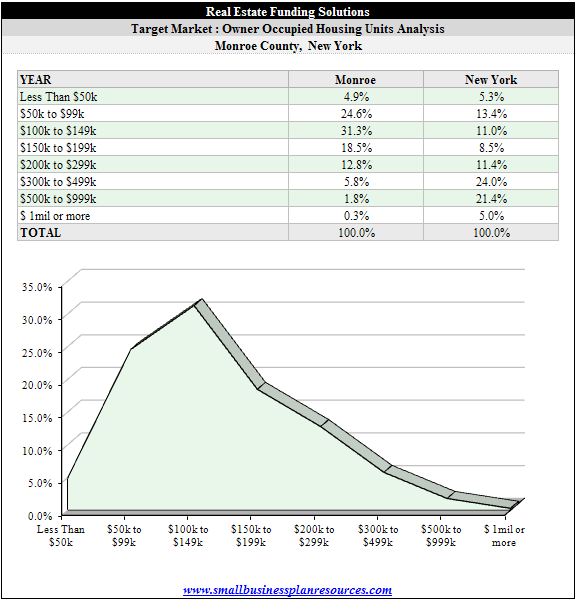

This analysis of owner occupied housing units distributed by the various market value buckets results in some interesting findings that has important implications for Real Estate Funding Solutions. Approximately 92% of the housing stock for Monroe county, New York has a market value of less than $300k compared to only about 50% for the state of New York. What this means of course is that the value of homes in Monroe county are much lower than the value of homes in the rest of New York state. When we look at the data more closely we find that almost 25% of the owner occupied housing units have a value of between $50k to $99k, compared with only 13.4% for the entire state - thus one of our every four homes in Monroe county that is occupied by owners valued at between $50k and $99k. Cleary what this means is that a mortgage broker business like Real Estate Funding Solutions will need to focus its energies on having a steady volume of business, and not focus as much on those large complex mortgage solutions that suck away a lot of time and resources. Lower market value of homes implies smaller mortgages, and that means smaller and less profit per transaction - the only way to make up for all that is to have a steady flow of volume.

This analysis of owner occupied housing units distributed by the various market value buckets results in some interesting findings that has important implications for Real Estate Funding Solutions. Approximately 92% of the housing stock for Monroe county, New York has a market value of less than $300k compared to only about 50% for the state of New York. What this means of course is that the value of homes in Monroe county are much lower than the value of homes in the rest of New York state. When we look at the data more closely we find that almost 25% of the owner occupied housing units have a value of between $50k to $99k, compared with only 13.4% for the entire state - thus one of our every four homes in Monroe county that is occupied by owners valued at between $50k and $99k. Cleary what this means is that a mortgage broker business like Real Estate Funding Solutions will need to focus its energies on having a steady volume of business, and not focus as much on those large complex mortgage solutions that suck away a lot of time and resources. Lower market value of homes implies smaller mortgages, and that means smaller and less profit per transaction - the only way to make up for all that is to have a steady flow of volume.

When we look at the rest of the market value distribution we find not surprisingly that homes above $300k only account for about 8% of the total owner occupied housing units in the county - the number for the entire state of New York is 50%. Thus clearly the distribution of the housing stock is skewed towards higher valued homes for the entire state of New York as compared to Monroe county. Thus it is very clear that there will be much fewer mortgages of higher valued homes in the county and it would not be a good idea to run after more profitable tickets since the time and energy wasted on chasing down larger mortgages that have a tougher time to close, is better expended on smaller mortgages. The business will have to focus on base hits more than home runs.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.