Home Roofing Contractor Free Roofing Contractor Business Plan 5.6 Sales Strategy

5.6 Sales Strategy

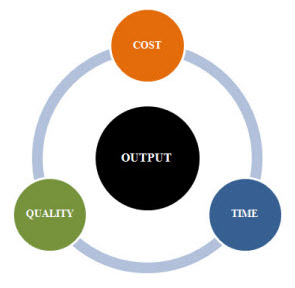

The sales strategy of Dependable Roofing entails breaking up the business into 3 distinct types of transactions:

The sales strategy of Dependable Roofing entails breaking up the business into 3 distinct types of transactions:

- Residential Work: Jobs done in typical residences will entail repair and replacement. These jobs will be done on a small scale and will most probably not require James and Carmine to hire any more help. Penalties for timely work completion are not as severe, job durations tend to be short, not much credit is required from suppliers to complete these jobs effective - often the material in inventory will suffice for successful job completion. It is anticipated that up to 90% of the firms total revenues will come from this category of transactions. Working on new construction residential structures will of course also involved installation of new roofs. Typically this work will be done by James and Carmine working as sub contractors under the general contractor building the dwelling.

- Commercial Work: These jobs tend to involve structured work where the effort is much higher and work restrictions and safety equipment needed can be stringent. Penalties for non-completion of work as per deadlines can be severe. These jobs often require extensive equipment and credit from supplies. Payments for these types of larger jobs can also take much longer with general contractors often taking between 60 to 90 days to pay the total amounts due. While the job durations for commercial projects tend to be longer, they also require plumbing contractors to hire extra crew. It is anticipated that the remaining 10% of all revenues will come from commercial work involving repair or reinstallation of roofs on small commercial properties that typically have between 5 to 10 mixed use structures.

- Government Work: Finally while there are no immediate plans to go after the government business, both James and Carmine anticipate that they will be looking to find pathways into

getting some dependable government work once they see that their firm is on sound financial footing.

Quick Links:

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.