Home Plumbing Contractor Free Plumbing and Heating Contractor Business Plan Templates 8.13 Debt to Equity Analysis Template

8.13 Debt to Equity Analysis Template

What is the Debt to Equity Ratio Template and why is it important in a business plan for a Plumbing and Heating Contractor?

What is the Debt to Equity Ratio Template and why is it important in a business plan for a Plumbing and Heating Contractor?

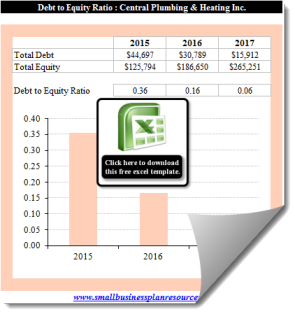

The Debt to Equity Ratio is a key ratio that is looked at by lenders and potential partners alike. The Debt to Equity ratio gives a small business owner like Felix Gonzalez the ability to present this key ratio in both numerical and graphical format to the readers of the business plan. The debt to equity ratio calculates the amount of leverage being employed by the firm when compared to the amount of equity invested by the owners of the firm.

As a general rule the lower the Debt to Equity firm, the better is it is for a small business like Central Plumbing & Heating Inc. and vice versa. This ratio is calculated by dividing the Total Liabilities or Debt by the Total Shareholders equity.

What calculations go into the Debt to Equity Ratio Template for a small business like Central Plumbing & Heating Inc.?

There are only two inputs that have to be entered into the Debt to Equity Ratio template input page. One is of course the Total Debt on the balance sheet of a small business like Central Plumbing & Heating Inc. and the other is the total shareholders equity which is of course the contribution of the shareholders along with the retained earnings. Once these items are entered, the template automatically updates the projected Debt to Equity ratio and then updates the graphic. You can click on the output tab and copy and paste the output directly into the business plan word document.

Quick Links:

- Go to the Corresponding Questionnaire section for this industry.

- Go to the Corresponding Business Plan section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.