Home Mortgage Broker Free Mortgage Broker Business Plan 4.7 Target Market Education Profile Analysis

4.7 Target Market Education Profile Analysis

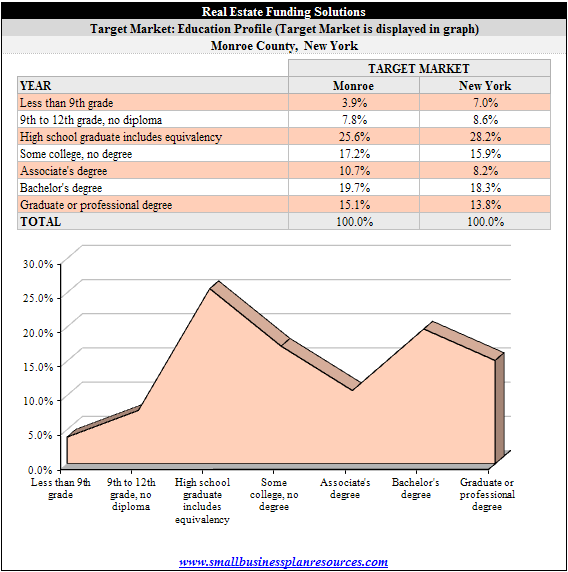

When conducting an analysis of the target market based on education, what stand out is that the folks in Monroe county are better educated on average than folks in the state of New York. Only 3.9% of the population of Monroe county has a less than 9th grade education compared with 7% of the statewide average. When we add up the last four categories of the education profile distribution bucket we find that 62.7% of the population of Monroe county has had at least When we add up the last four categories of the education profile distribution bucket we find that 62.7% of the population of Monroe county has had at least some college and higher levels of education. That number for the state of New York is 56.2% which of course reflects that better levels of education for the county.

When conducting an analysis of the target market based on education, what stand out is that the folks in Monroe county are better educated on average than folks in the state of New York. Only 3.9% of the population of Monroe county has a less than 9th grade education compared with 7% of the statewide average. When we add up the last four categories of the education profile distribution bucket we find that 62.7% of the population of Monroe county has had at least When we add up the last four categories of the education profile distribution bucket we find that 62.7% of the population of Monroe county has had at least some college and higher levels of education. That number for the state of New York is 56.2% which of course reflects that better levels of education for the county.

We feel that this can be attributed to the presence of community colleges, accredited colleges and universities in the county that afford the local population the ability to access education relatively easily.

A well educated population means that a mortgage broker like Real Estate Funding Solutions has the opportunity to set itself apart from the rest of its competitors by providing its clientele with well documented pre-approval documents and can use online mortgages newsletters and other forms of direct marketing that has a chance of being more effective given the better education profile of the target market. of being more effective given the better education profile of the target market.

Very often, we have seen unfortunate stories coming of folks living in less well to do neighborhoods being manipulated by mortgage brokers into loans that are not appropriate for them. An educated and well informed consumer can quickly separate the wheat from the chaff when it comes to shady sales tactics and therefore it is highly recommended that every effort be made by firms like Real Estate Funding Solutions to educate and inform their consumers about the various financing options open to them and give them as much information as possible about the fees and costs associated with a residential financing. The better education profile of Monroe county, lends itself to success for those mortgage brokers that are able to educate and inform their customers better than their competition.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.