Home Mortgage Broker Free Mortgage Broker Business Plan 4.4 Estimated Households by Income Class

4.4 Estimated Households by Income Class

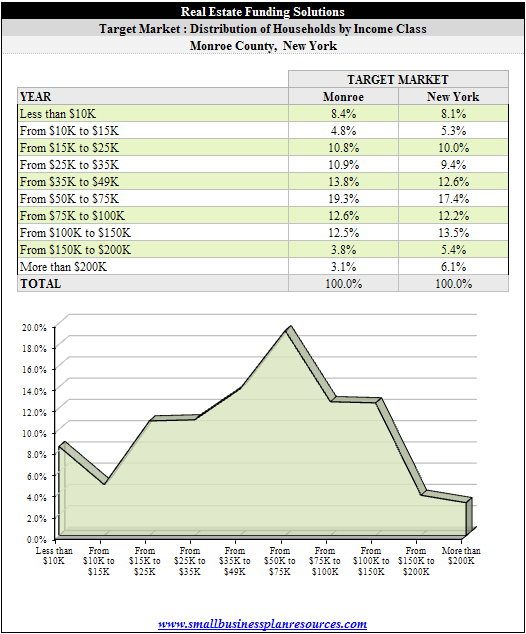

An analysis of the distribution of households by income classes for Monroe county, New York shows comes up with some interesting findings. For the most

An analysis of the distribution of households by income classes for Monroe county, New York shows comes up with some interesting findings. For the most

part the income distribution for folks up to 49k per year is higher than that for the State. Thus when we combine the income first five income categories of incomes from $0 to $49k per year, we find that a total of 48.7% of the households in Monroe county, make less than $49k. On the other hand that number for the State of New York comes in at 45.4%. Clearly this means that a larger proportion of households in Monroe county are making less than $49k when compared to the State - income per household is highly co-related with housing values.

When we lump the next three categories of income distribution - from 50k to 150K, we find that Monroe County edges out the State of New York since 44.4% of its households make between $50k and $150k compared to 43.1% for the state of New York. This bodes well for housing values since a large percentage of the housing stock is typically owned by folks that fall in this income category. Folks that fall in the lower income distribution categories of say less than 25k, tend to have a lower home ownership rate.

Finally when we lump up the two highest income categories to look at all households with income more than $150k, we find that Monroe county lags the State of New York by a very large number. Only 6.9% of the households in Monroe county make more than $150k compared to 11.5% for the State of New York. This has clear implications for Real Estate Funding Solutions - since income distribution has a high correlation with housing values, it means that there will be much fewer high value homes in Monroe county resulting in fewer large mortgages when compared to the rest of the State. Ryan and David will have to understand this dynamic and focus on sticking with smaller margins for their financing solutions to keep themselves competitive but ensure that they are able to generate sufficient volume of business to meet their sales goals.

Quick Links:

- Go to the Corresponding Template section for this industry.

- Go to the Corresponding Questionnaire section for this industry.

Small Business Owner Resource Center

Articles on the Small Business Financing Sources, the Small Business Loan Basics, small business loans Checklist and SBA Loans are incredible sources of knowledge for the small business owner.

Credit Report and Credit Score Analysis, how to Read a Personal Credit Report and all about Business Credit cover the intricacies of credit and are required reading for everybody.

The Foundation Grant Directory is a free listing of sources for grants by state. Why not look if there is some free money out there for your business. Hey - you never know!

The Business Loan Application covers every item you will need in your loan package and tells you how to get approved for business loans.

Fire your loan broker and use our Free Business Loans Bank / Lender Directory to find every bank in the country lending to small businesses.

If you are looking to start a business - look no further. Check out the Free Incorporation Guide discussion and the State Incorporation Resource Directory.